1. Are there any preconditions before I can apply for Registration as a Non-Resident Taxable Person?

A Non-Resident Taxable Person must fulfill the following conditions so that he/she can register on the GST Portal:

- Applicant has authorized signatory in India with valid details

- Authorized Signatory has valid Permanent Account Number (PAN)

- Authorized Signatory has a valid Indian mobile number

- Authorized Signatory has valid E-mail Address

- The applicant has a Permanent Account Number (PAN)/ Passport Number / Tax Identification Number (TIN) or unique number on the basis of which the entity is identified by the Government of that country

- The applicant has the prescribed documents and information on all mandatory fields as required for registration

- The applicant has identified a place of business in that State for the period of registration.

2. I am a Non-Resident Taxable Person. What is the process to obtain a GST Registration for a Non-resident Taxable Person?

As a Non-Resident Taxable Person, you must fill Part A of the Registration Form, which consists of:

- Legal Name of the Non-Resident Taxable Person

- Permanent Account Number (PAN) of the Non-Resident Taxable Person/ Passport Number of the Non-Resident Taxable Person/ Tax Identification Number (TIN) or unique number on the basis of which the entity is identified by the Government of that country

- Name of the Authorized Signatory (as per PAN)

- PAN of Authorised Signatory

- Email Address of Authorised Signatory

- Indian Mobile Number of Authorised Signatory.

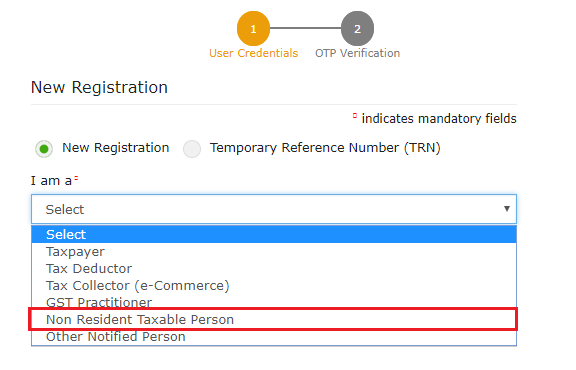

Remember to select Non-Resident Taxable Person in the mandatory dropdown – ‘I am a’

Please refer to the screenshot below:

Once, the PAN, email, and mobile number are validated, a Temporary Reference Number (TRN) will be generated and communicated to you via SMS and email. Based on the generated TRN, you will be able to retrieve the application and fill in Part B of the application form.

On successful submission of the application with authentication, the Application Reference Number (ARN) will be generated and intimated to you via email and SMS.

You can track the status of the application using this ARN.

Once the application for registration is approved, the GSTIN and temporary password are generated and communicated via e-mail and SMS to the primary Authorized Signatory. Status of the GSTIN changes from “Provisional” to “Active”. Registration Certificate (RC) is generated and is available on your Dashboard to view, print and download.

3. Do I need a PAN to obtain registration as a Non-Resident Taxable Person?

No, PAN is not mandatory for obtaining registration as a Non-Resident Taxable Person. You need any one of the following three:

- Permanent Account Number (PAN) of the Non-Resident Taxable Person OR

- Passport Number of the Non-Resident Taxable Person OR

- Tax Identification Number (TIN) or unique number on the basis of which the entity is identified by the Government of that country

However, you must have an authorized signatory who is a resident of India with a valid PAN and give its details in Part A of the application.

4. Do I need an Indian mobile number to obtain registration as a Non-Resident Taxable Person?

You must have an authorized signatory who is a resident of India with a valid Indian mobile number and give this Indian mobile number in Part A of the application.

5. How can I view my existing registrations mapped to the same PAN of the business/ entity on the GST Portal while applying for registration?

After filling in all the details in Part A of the application, when you click on Proceed button, GST Portal displays all the GSTINs / Provisional IDs / UINs / GSTP IDs mapped to the same PAN across India.

6. Can I use the same e-mail address, mobile number, and PAN combination for taking multiple registrations on GST Portal?

Yes, you can use the same e-mail address, mobile number, and PAN combination for taking multiple registrations on GST Portal.

7. Do I need a place of business in the state I intend to carry out business in?

Yes. Before you apply for registration, it is mandatory to have a place of business in the state you intend to obtain the registration, so that its details can be given in Part B of the application.

8. Where can I add Bank Account details?

Details to be entered in the Bank Accounts tab have been made optional and non-mandatory w.e.f. 27th Dec 2018. You can now enter the Bank Accounts details by filing an Amendment application only. Post-grant of GSTIN, when you log in for the first time on the GST Portal, you will be prompted to file a non-core amendment application to enter Bank Accounts details.

9. When should I apply for a Registration as a Non-Resident Taxable Person?

You should apply for Registration as a Non-Resident Taxable Person at least 5 days prior to the date of commencement of business.

10. What are the documents the need to be uploaded while applying for Registration as a Non-Resident Taxable Person?

| Document Name | Document Type | Document Size |

| Proof of Appointment of Authorised Signatory | ||

|

Photo of the Authorised Signatory |

JPG |

100 KB |

|

Letter of Authorisation |

JPG, PDF |

100 KB |

|

Copy of Resolution passed by BoD/ Managing Committee and Acceptance letter |

JPG, PDF |

100 KB |

| Proof of Principal Place of business | ||

|

Own: Property Tax Receipt OR Municipal Khata copy OR Electricity bill copy OR Legal ownership document |

JPG, PDF

|

Property Tax Receipt – 100 KB Municipal Khata copy – 100 KB Electricity bill copy – 100 KB Rent/ Lease agreement – 2 MB Consent Letter – 100 KB Rent receipt with NOC (In case of no/expired agreement) – 1 MB Legal ownership document – 1 MB |

|

Leased: Rent/ Lease agreement OR Rent receipt with NOC (In case of no/expired agreement) AND Property Tax Receipt OR Municipal Khata copy OR Electricity bill copy OR Legal ownership document |

JPG, PDF

|

|

|

Rented: Rent/ Lease agreement OR Rent receipt with NOC (In case of no/expired agreement) AND Property Tax Receipt OR Municipal Khata copy OR Electricity bill copy OR Legal ownership document |

JPG, PDF

|

|

|

Consent: Consent letter AND Property Tax Receipt OR Municipal Khata copy OR Electricity bill copy OR Legal ownership document |

JPG, PDF

|

|

|

Shared: Consent letter AND Property Tax Receipt OR Municipal Khata copy OR Electricity bill copy OR Legal ownership document |

JPG, PDF

|

|

|

Others: Legal ownership document |

JPG, PDF

|

|

| Proof of Details of Bank Accounts | ||

|

First page of Pass Book |

JPG, PDF |

100 KB |

|

Cancelled Cheque |

JPG, PDF |

100 KB |

|

Bank Statement |

JPG, PDF |

100 KB |

11. How long is the Registration as a Non-Resident Taxable Person valid? Can I extend my Registration as a Non-Resident Taxable Person?

The certificate of registration issued to a Non-Resident taxable person is valid for the period specified in the application for Registration or 90 days from the effective date of registration, whichever is earlier.

You can extend your Registration as a Non-Resident Taxable Person once, for an additional period of 90 days, if you apply for an extension of registration before the expiry of the initial period of registration granted to you.

12. I have already extended my initial registration once and cannot extend it a second time as per prevailing laws. What do I do if my extension is about to expire and my business has not concluded?

In such a case, you are required to obtain registration as a normal taxpayer in the concerned state.

13. The moment I select Registration as a Non-Resident Taxable Person option, the New Registration Application forms prompt me to fill a GST Challan. Why?

In case of Registration as a Non-Resident Taxable Person, you are required by law, to deposit the tax in advance, equivalent to the estimated tax liability, based on the estimated turnover for the period for which the registration has been obtained by you.

A provisional GSTIN will also be generated and prefilled in the challan. The status of this GSTIN will be provisional until your application is approved by the tax authority and the registration is officially granted.

14. Is there a fixed amount I must deposit before taking a Registration as a Non-Resident Taxable Person?

No, there is no fixed amount you must deposit before taking a Registration as a Non-Resident Taxable Person. You are required by law, to deposit the tax in advance based on the estimated turnover for the period for which the registration has been obtained by you.

15. How can I submit my registration application?

You can submit the Registration Application using DSC/ E-Sign/ EVC.

16. What are the various statuses of the application?

| Sr.No. | Action Description | Status |

|

1 |

Status of the Registration Application when the Application is saved but not submitted |

Draft |

|

2 |

On submission of the Registration Application until ARN is generated |

Pending for Validation |

|

3 |

In case the validation fails, on submission of the Registration Application |

Validation Error |

|

4 |

Status of the Registration Application on successfully filing and generation of ARN |

Pending for Processing |

|

5 |

Status of GSTIN, when create challan is initiated till Registration Application is approved |

Provisional |

|

6 |

Status of the Registration Application when the Application is approved |

Approved |

Note: ARN in case of Non-Resident Taxable Person can only be generated once payment of advance tax is done.

17. How is State and Centre Jurisdiction displayed in the “Principal Place of Business” tab?

Based on the pin code entered in the “Principal Place of Business” tab by the applicant, State and Centre Jurisdiction gets displayed in the drop-down option for them.

Note: The display of the jurisdiction is based on the PIN codes mapped with these jurisdictions.